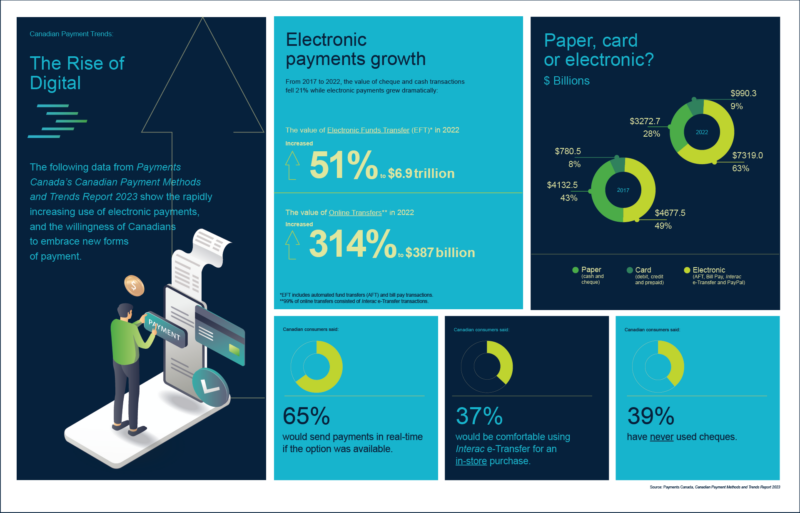

The recently released Canadian Payment Methods and Trends report by Payments Canada shows Canadians are embracing digital payments like never before. Delving into the data, we discover that electronic funds transfer (EFT), which consists of automated fund transfers (AFT) and bill payments, increased 51 percent when looking at the five-year trend from 2017 to 2022. Based on monetary value, EFTs make up a whopping 60 percent of all payments value in Canada—more than all other payment types including cash, cheques, credit and debit cards combined.

Online transfers—which in Canada consist almost exclusively of Interac e-Transfer transactions—grew at an even faster rate: 314 percent 2022 vs 2017. While online transfers are still a relatively small percentage (six percent) of overall payments value, these numbers indicate growing acceptance of e-Transfer as a go-to payment method for peer-to-peer transactions among Canadians. We expect e-Transfers to continue this growth trend, especially as Interac e-Transfer for Business becomes more widely prevalent.

Over the same 2017 to 2022 time period, the value of cash and cheque payments combined fell 21 percent. Debit and credit card use increased in line with overall growth in the value of transactions. In total, Canadians made 20.5 billion transactions in 2022, totaling $11.7 trillion. That’s more than $475 billion in transactions every business day.

An interesting fact revealed by the report is that 39 percent of Canadians surveyed have never used a cheque in their life.

Digital Payments and PPJV

If you’ve been hedging on upgrading aging payments services and infrastructure, the data is clear: the digital and online payments revolution in Canada is only getting stronger. Modernized digital payments infrastructure that is flexible, scalable and reliable is essential and will become a necessity once new standards for data-rich payments (i.e., ISO 20022), real-time rail and open banking take effect. Check out PPJV’s modernized digital payments products and services: one solution for staying competitive in the future of payments.