A major challenge faced by financial institutions looking to embrace the opportunities of payments modernization is the need to deal with the elephant in the room: legacy banking systems.

You can’t simply flip the switch to turn on the latest innovations in digital banking. It’s not as simple as moving your current codebase onto the cloud. We must find ways to integrate new platforms and technologies with legacy banking infrastructure. This can involve overhauling or replacing legacy technologies. For those who can’t afford something quite so dramatic, it can involve the development of integration layers to connect modernized payments platforms with core-banking architecture (this is something we at PPJV are working on with our credit union and technology partners).

Either way, and in almost every case, the task is not as easy as one might envision or hope. It’s one of the reasons so many payments modernization initiatives around the world have run into time delays and expanding budgets.

But why is dealing with legacy banking systems both a challenge and a necessity? There are a few key reasons for this.

The challenges of legacy architecture

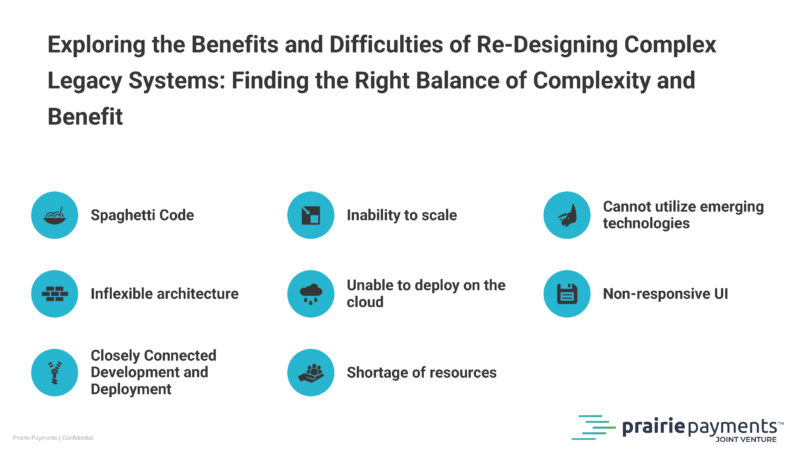

The first challenge is something we call spaghetti code. Most current banking technologies were created years or decades ago. Over time, incremental updates and upgrades have created new layers of complexity. Making matters worse, documentation of changes to these systems is rarely well maintained.

The ability to decipher how legacy systems work: for example, figuring out the logic underlying routing rules, is almost never easy. Too often, this information becomes tribal knowledge, built up over generations of code, involving differing departments, personnel and IT providers, with no single entity truly knowing the whole picture.

To those tasked with modernizing payments infrastructure, the code underlying legacy banking architecture is often like a giant pile of spaghetti. Everything is jumbled together, and the effort to reliably pull out the particular section of code you need to work on, update or connect to can be exceedingly difficult.

This coding conundrum has serious consequences with respect to modernization. One is that many legacy platforms simply cannot scale and grow—and the ability to scale is generally a prerequisite of modern payments technologies. As an example, the inability to scale and grow has been a limiting factor for modernizing AFT. Even the Bank of Canada standards around AFT and the file exchange protocols have not changed significantly since 1986.

It also leads to an inability to readily take advantage of new and emerging trends and technologies: for example, deploying to the cloud, utilizing agile deployment and implementing code as a service.

Another challenge with legacy systems is they were typically built using inflexible architecture. Back in the day, each payment system was thought of as a single service: you decided ahead of time whether you were going to send a cheque or a wire, for example, and you did the things necessary to make that particular payment happen.

Nowadays, consumers demand flexibility and choice. They want access to their different payment options within their online accounts and digital banking apps. Modern payment systems require closely connected development and deployment, responsive user interfaces and payment stream interoperability. None of these are attributes commonly associated with legacy banking systems.

Finally, it’s worth noting that industry-wide, the technical expertise needed to manage legacy systems for things like AFT and cheques is dwindling. The last major cheque implementation was back in 2005. There is a growing shortage of talent and resources for those who remain locked into legacy systems, creating a real risk through retirements and attrition of losing the workers and knowledge-base needed to maintain those systems.

A report by Accenture says legacy systems create significant technological debt for financial institutions. Today, 40 to 60 percent of their IT budgets go to simply maintaining legacy systems. This, of course, makes it difficult for these institutions to find the often significant resources needed to invest in modernization.

The modernization imperative

Yet the imperative to invest in updating infrastructure is clear. Legacy systems are generally slow and inefficient compared to modern approaches, based on outdated technologies and manual processes. Also problematic is that many lack modern security features and thus are susceptible to cyber attacks. Legacy systems present a competitive disadvantage that will only grow with time.

It is a fact that payments modernization requires significant investment of both resources and time, not only to take advantage of the latest digital payment technologies, but to fundamentally upgrade and prepare your basic banking infrastructure to be ready for those technologies.

Payments modernization is a journey, and like any journey, it has its share of opportunities and challenges. Given the significant potential economic upside of new payment technologies, as well as the inefficiencies, cost and risks associated with legacy systems, the question is not whether you can afford to modernize—but how can you afford not to?