In the payments world, PaaS stands for Payments as a Service.

Basically, it’s the idea of taking payment processing technology outside an individual financial institution, and having it provided instead by a third-party vendor. The vendor specializes in offering payments as a service using cloud-based technologies, including hardware, software, services, and support, all bundled together.

PaaS fits under the umbrella of other cloud-based “as a service” solutions. For example: SaaS, or software-as-a-service, offers cloud-based software services that replace software that used to live on people’s personal computers. An example most of us are familiar with is Office 365. Not to confuse things, but SaaS companies looking to enable payment processing on their platform, will often procure the services of PaaS companies themselves.

The advantages of the “as a service” model include lower up-front IT and development costs, always-on 24/7 access through the Internet, scalability, and a cost-effective solution where the third-party is there to ensure regular maintenance and security updates, and periodic upgrades to continuously improve the service and meet the evolving needs of clients.

What types of payments are handled by PaaS?

There are five types of payments commonly handled by financial institutions today that can be a part of PaaS in Canada:

- e-Transfer: Payments made digitally by sending instructions via email on how to retrieve funds, sort of like an e-cheque. Since COVID, e-Transfer adoption has gone through the roof: between April 2021 and April 2022, there were more than one billion e-Transfer transactions in Canada.

- AFT or Automated Funds Transfer: A banking arrangement where transfers are made on a regular, periodic basis, moving funds from one account to another (e.g., payroll deposits).

- Bill Pay: The transfer of funds from a customer to a vendor to pay a one-time or recurring bill (e.g. payments to your electrical utility).

- Wires: Used to move money electronically across a network of banks, agencies or transfer providers, either domestically or internationally.

- Cheques: A written and signed document that orders a financial institution to pay a certain amount of money from the payer’s account to the payee named on the cheque.

PaaS is also used to provide centralized services and support, including fraud management and cyber security.

Why is PaaS needed?

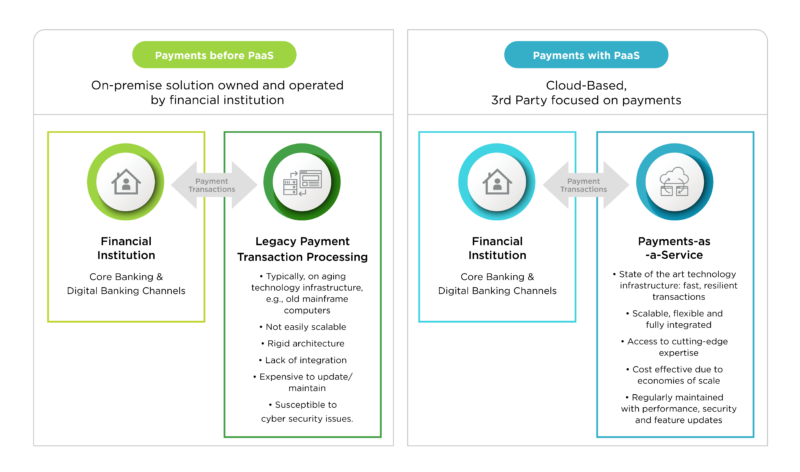

In the past, payments services were handled by software programs on dedicated mainframe computers. In most cases they were operated “on premise” within a financial institution, with day-to-day maintenance and operations handled by that institution’s IT and operations department and/or third-party consultants.

This approach worked well for decades, and many financial institutions still rely on in-house solutions. However, recent trends toward fast, digital online payments and rapidly evolving technologies and standards are causing challenges legacy systems are ill-equipped to handle. At the same time, game-changing opportunities to enhance competitiveness are available to those willing to embrace modernized approaches like PaaS.

Legacy systems are challenged because they typically do not have the speed, flexibility or scalability to readily adapt to the requirements of new and emerging digital payments technologies. To make them do so would require costly upgrades as well as technical expertise that is in short supply.

Meanwhile, the emergence of cloud-based platforms creates the opportunity for payments services to be moved onto cloud servers utilizing the latest Internet infrastructure that is fast and scalable. A third-party vendor can assemble both the cutting-edge technology and highly specialized and sought-after expertise needed to develop, maintain and continually update the payments platform on behalf of its clients.

An example of one payments platform is the IBM Payments Centre Canada (IPCC), a cognitive payments platform built on the IBM Cloud which combines infrastructure, software, application and business operations support under one platform.

Credit unions and the benefits of PaaS

Beyond the use of advanced hardware and software technologies, PaaS offers clear benefits to small- to medium-sized financial institutions like credit unions in Canada. These include:

Cost and Time Savings:

The up-front cost and time needed to develop an in-house solution from scratch, or to upgrade an existing solution to meet the requirements of evolving digital payment technologies, is prohibitive for all but the largest financial institutions.

Through PaaS, development and maintenance costs are shared across the vendor’s clients, leveraging the economies of scale and avoiding unnecessary duplication—each client is not forced to ‘reinvent’ the wheel.

As well, PaaS clients can achieve cost savings by pooling their payments transactions to negotiate more favourable transaction rates based on volume.

Access to Talent and Expertise:

It would also be challenging for small- to medium-sized financial organizations to access the high-end talent need to develop and maintain modernized payments systems. For example, according to ZipRecruiter, the average annual pay for a Cloud Engineer is $132,478 USD. Instead of ten credit unions competing to hire a cloud engineer, they can as a group benefit from the expertise of one cloud engineer working for their PaaS vendor.

As an organization focused solely on payments services, a PaaS can assemble a group of specialists who are extremely knowledgeable on payments technologies and standards, and can remain committed to developing efficient, cost-effective and leading-edge solutions.

Flexibility and integration:

Modern payment systems require the development of flexible architectures that work across different digital channels and platforms. Today’s consumers also demand solutions be tightly integrated—so different payment types can be accessed conveniently from one point of access such as an app or online account.

While PaaS leverages economies of scale by developing core products to be used by multiple clients, modern digital standards like APIs also enable PaaS to offer flexible connectivity to these core products. This means individual organizations or groups of clients can work with PaaS to develop a customized solution that meets their particular circumstances or needs.

Built for long-term growth, agility and risk mitigation

PaaS can offer payments solutions hosted on the latest cloud server technologies that are fast, always-on and resilient. PaaS services are also highly scalable, meaning they can meet the needs of financial institutions as they grow.

PaaS also offers services like security monitoring, centralized fraud prevention, performance updates, help training and support, and regular product upgrades—effectively outsourcing a suite of functions that would be difficult and expensive for a small to medium financial institution to support and maintain over the long-term.

Effectively, PaaS enables smaller financial institutions to offer their clients a higher-end, better-maintained product than would be possible if developed in house.

Future Ready

Because PaaS operates on modern cloud networks and platforms with access to leading-edge talent, it is future-ready. Modernized infrastructure means that as payments innovations like real-time payments, open banking and digital identity take hold, they can be readily incorporated into the PaaS framework of products and services. Think of it as having your plumbing ready for the newest and coolest faucets coming to Canada, that in many cases, are already being used around the world.

The benefits of ownership: PPJV

The prairie credit union approach to PaaS in Canada takes things a step further. Rather than simply being one client among many to a PaaS vendor, prairie credit unions have joined together to build and manage their own PaaS solution, through the creation of the Prairie Payments Joint Initiative (PPJV).

While utilizing IBM’s IPCC platform, PPJV was created to give oversight into the development of PaaS customized to meet the particular needs of its prairie credit union owners. The joint venture gives small- to medium-sized credit unions a strong, collective voice, in full partnership with IBM and other technology vendors.

PPJV is owned by prairie credit unions through their membership in three prairie credit union associations: Alberta Central, SaskCentral and Credit Union Central of Manitoba.

PPJV acts as a system integrator, working with multiple vendors and subsystems to work towards a consolidated PaaS solution, with centralized management of operations. Through PPJV, individual credit unions are able to have their say in ensuring their PaaS works for them, including the development of a solution customized to work with their legacy banking systems.

Is PaaS for you?

There are multiple benefits of PaaS, particularly for small- to medium-sized financial institutions faced with the daunting and expensive task of modernizing their payments services. Clients are clamoring for digital payments that are fast, always on and flexible to meet their needs. A robust PaaS partnership enables financial institutions to meet those needs while staying prepared for the next big thing in payments services.